How do we improve airdrops

What airdrop design helps to ensure customer lifetime value > customer acquisition cost?

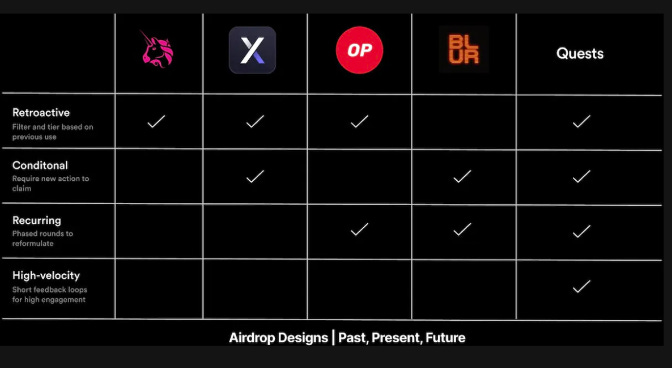

In our last article, we looked at how airdrop design up until the past year has been flawed and characterised by problems around a protocol’s inability to iterate and run minimum viable airdrops, destroying community sentiment, discouraging further use and diluting the effects of decentralisation through poor sybil resistance and negative price action.

Using web2 speak, community distribution = customer acquisition. All tech startups optimise to ensure that customer acquisition costs (CAC) are lower than the lifetime value (CLV) of said customer. During growth phases, many tech startups are happy to burn cash as long as they are seeing respectable CLV/CAC. Poorly designed airdrops are a marketing spend, whilst if not designed to encourage retention the CLV of an airdrop recipient, which would be the protocol earnings a user brings has the potential to be next to nothing.

So how do we improve this / improve distribution?

Tokens are a tool to solve the cold start problem as they are used to acquire new users. As a founder it is important that this falls into the hands of the right people - those that will repeatedly use your protocol and have a high CLV. Failure to do so will leave your token falling into the hands of mercenary capital which will likely be dumped.

So far we have looked at retroactive and conditional airdrops, which are essentially free money to recipients. To be completely honest, as a receiver of some of these - I love them and the desire to reward the earliest members of a community. Let’s take the opposite side of the trade for the moment - if I was a new user and didn’t get the airdrop I could feel like I may have missed a protocol which can hurt adoption. So rather than one-time airdrops we should be striving for a recurring approach to airdrops. We can then take this a step further with an options airdrop (more later) where the recipient doesn’t receive free money but can still purchase tokens at a discount, better aligning incentives between user and protocol.

Recurring’ Airdrops: 2022-2023 | Optimism, Blur

Recurring airdrops is as the name suggests; a series of airdrops that occur over a given time period. The advantage recurring airdrops give is the incorporation of more feedback into the incremental design.

This benefits in the following ways:

Protocol can iterate on criteria, optimise and test new hypotheses, improving overall protocol health.

Able to partially mitigate somewhat wasteful practice of large initial distributions.

Eligibility requirements can be updated to reduce sybil farming in successive distributions.

Blur and Optimism’s phased airdrops are great examples of recurring airdrops. Both utilised a phased approach to token distribution whilst maintaining eligibility requirements.

Future airdrops

Velocity quests-based approach

Rabbithole posted an article who believe airdrops will adopt a quests-based approach in the future. Such a design takes on principles we have discussed including:

Phased approach to airdrops with minimum viable rewards for initial distributions.

Said approach can drive faster feedback cycles that allow protocols to iterate until they achieve their desired results.

Once achieved, they can utilise larger airdrop amounts to fuel growth.

Furthermore, quests can also be used as a mechanism for conditional claiming as projects will require users to take specific on-chain actions in order to claim their airdrop.

Alternative airdrop methods

Aside from a quest-based approach, how else could we improve existing design?

Vesting airdrops based on time (claimable over a period of 3 months, over a weekly basis)

Vesting airdrops based on milestones (claimable after certain actions are completed)

Vesting airdrops based on a combination of time & milestones (claimable over certain periods based on how well users retain engagement with the protocol)

But more importantly, have a deeper think about token utility before airdropping them to the masses

How to improve retroactive airdrops?

1) Design a minimum viable airdrop

The design has to be reasonably small.

Why? Because it is a simple sybil-defense mechanism that recognises that a user who puts 0.1 ETH vs a user that puts in 10 ETH.

For example, with Uniswap users any user who traded received 400 UNI, about $1000 at the time.

How to further improve on this?You could have a secondary tier about the MVA only available to those who complete multiple steps. Supply token to vault > use native bridge > make trade(s) > provide liquidity weighted by time x amount

2) Reward your most valuable users

For example, Uniswap accomplished this by making their airdrop time+stake weighted -- people that LP'd since 2019 received far more than people who LP'd for a week in 2020.

dYdX reated several different volume tiers.

3) Vesting / additional steps

Have a threshold above which rewards have vesting or additional steps needed to claim. These steps should then incentivise whales to take actions that can further help the protocol grow. For example:A user gets 20% unlocked after the first transaction, another 20% after 100k in trading volume and so on. Such a design encourages people to try out different areas of the product and helps to encourage sticky usage.

KPI based vesting. - Could be per-user and total KPIs - For instance, total trading volume on the platform

Time-based vesting - Say a 1 or 2 year vesting period instead of straight unlocked tokens. - The actions should lead to outcomes that add value, which can’t be controlled in time-based vesting. - However, you could incorporate accelerated vesting if you participate in governance or perform other actions for example.

4) Options airdrop

If not mistaken, Tapioca are the first protocol to run an options airdrop - so what is this? Tapioca will distribute American-style call options via its oTAP token instead of distributing free $TAP tokens en masse.

Call options give a user the option, but not the obligation to purchase $TAP at a discount from the Tapioca DAO. As discussed in our previous article, airdrops suffer from issues of attracting mercenary capital, does not necessarily expand userbases or create retention and are subject to sybil attacks. None of these attract long-term, loyal users to the protocol.

An options airdrop helps mitigate misaligned incentives as

mercenary capital can still profit from airdrops as their OTC buys are discounted.

Funds received by the DAO will go towards POL making it more attractive for those who wish to trade the token.

Disincentivises sybil attackers from "gaming" the Tapioca call option airdrop because the tokens are not free.

Still rewards loyalty community members who are able to buy tokens at a discount improving retention.

Stay turned next week for case studies delving deeper into all the airdrop types discussed to date!