TL;DR Everything Arthur Hayes

A summary of Mr Hayes' recent articles and a deeper dive into what conditions around Yield Curve Control will lead to a $1m Bitcoin.

We’re massive fans of Arthur Hayes’ articles and we seriously recommend that everyone finds the time to read them. If you can’t, the article below aims to summarise some of his most recent pieces, but we also aim to debunk Hayes’ thesis that YCC = $1 Bitcoin. Not that we don’t want this to happen but QE in a vacuum doesn’t lead to risk on rallies nd we try to explain what events happening today could ultimately cause central banks to facilitate such an event.

Since 2008, one can argue we’ve had a decade-long bull-market, in part caused by huge amounts of stimulus and quantitative easing - something sovereign governments turned to the max in order to save their economies from capitulating in the fall of COVID. In turn, continents such as Europe, and America and countries like Japan have amassed high levels of debt relative to their GDP. Therefore, a country can service its debt in one of 3 ways:

Gas prices and inflation

In the past week, supplies of gas to Germany through Nord Stream 1 have been turned back on but are only running at 20% of their capacity. Combined with inflation running at 40-year highs, we can expect much higher energy prices come winter. With Germany and the rest of Europe facing the very real prospect civil unrest this winter, one of the only ways governments can thwart this is to offer subsidies. What mean I hear you say? To pay the subsidies, the government will need to generate more cash, which would necessitate the issuing of more Treasury bonds, due to a widening fiscal deficit. The result is that Central Banks will need to buy back these bonds in order to cap yields below the rate of interest, explicitly or inexplicitly this is Yield Curve Control (YCC).

Subsidies and YCC

Bonds are one of the safest investments one can make as it is guaranteed yield by your government. However, when people are bearish on economic growth, people buy fewer bonds, demand goes down and yield goes up. A central bank will need to cap yields at a given point along the yield curve because if yields keep rising, then so does the cost of governments servicing their debt. US, Europe and Japanese debt/GDP ratios are already at historical highs. Between defaulting on debt and excessive money printing, governments will never choose the former due to the contagion effect, the solution is always to print more.

YCC & why this is problematic for the EU

In ordinary times, the ECB would follow the same playbook as the US to raise interest rates to combat inflation. Europe can’t raise rates at the same pace as the US as it would make it increasingly harder to purchase the bonds of weaker member states (Portugal, Italy, Greece and Spain) to finance their debt to stave off a debt default. Assuming this becomes untenable, the only option PIGS’ would have would be to go off the Euro and redenominate the Euro debt into local currencies (and print more money to service this). Then Northern European banks who lent to these nations would then be paid off in a highly devalued local currency but would owe Euros to investors leading to a likely period of hyperinflation.

Exacerbation with Germany

As of 2021, the EU as an economic bloc ran a current account surplus with the world in which Germany is far and away the biggest net exporter in the EU. Globally, it is second behind China in its 2021 current account surplus.

As a result of the ongoing war, prices for gas and oil rose by 301% and 106% respectively.

A price increase in raw materials naturally gets passed down the manufacturing process which ends at the consumer. Relative to last year, German-produced goods will increase in price and a decrease in price competitiveness vs the rest of the world. For the first time in 30 years, Germany ran a current account deficit! In order for the EU as a bloc to run a deficit would require a 23% reduction in German exports or a 23% rise in imports. The closer the EU moves to running a current account deficit, the doom loop of currency devaluation accelerates. Why?

A C.A deficit is when a country’s imports > exports. As a result, there will be a net outflow of money from a country’s circular flow. Households and businesses pay for imports in their own currency, but this is eventually converted into the currency of the exporting nation. Essentially, the EU will require more foreign currency than it receives through the sale of exports which means it supplies more of its own currency than the demand from foreigners for goods and services. This leads to an increased supply of the Euro in FX markets, devaluing the Euro until domestic goods and services are cheap enough for foreigners.

Problems already in Japan

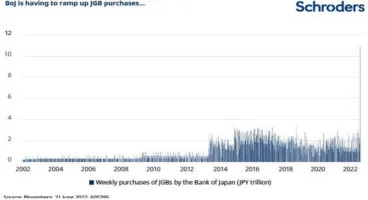

Whilst Europe and the US are thinking about engaging in YCC, Japan is already heavily underway.

In 1989, Japan’s real estate market collapsed and in order to offset the deflationary effects of a bursting asset bubble, the Bank of Japan descended into money printing. The following has meant that Japan now runs a staggering debt/GDP ratio of 259%. Remember, Japan could offset its debt by selling it to domestic entities, however, Japan’s ageing population would not be able to support the increase in productivity needed to do so. Without a growing user base, there is no increase in activity for a government to tax. And as a government’s tax inflows stagnate or shrink, its debt servicing costs become unbearable. Alternatively, they could find cheaper sources of energy. After the Fukushima nuclear meltdown of 2011, Japan decided to shut down all their nuclear power plants so domestically produced energy is not an option. Since the US and Japan are also close allies, as of right now Japan won’t buy cheap Russian gas to fuel productivity either. This leaves Japan with the options of a) hard default (no country ever willingly does this) or b) inflate the debt away.

As a free market would not buy Japanese bonds with a 0.25% yield, Japan must buy all government's bonds to cap their JGB yield. However, it is running out of bonds to buy. Of course, the BOJ can issue more bonds but with greater supply, demand decreases in relative terms, causing the price of the bond to fall and yields to rise, which results in higher bond purchases and a vicious cycle of devaluation. Eventually, the excessive money printing will cause those selling commodities to Japan to demand a hard currency as YTD the Yen has lost >20% of its value vs the Dollar.

Mr Hayes’ thesis

As you can see, Europe and Japan are rapidly spiralling into a sovereign debt crisis. In order to prevent Europe and Japan from spiralling into a debt crisis, In order to help prevent this, Mr Hayes’ has the following thesis for the US to solve this:

The central bank prints fiat currency (they’ll use Federal Reserves first)

Which they will purchase bonds to artificially cap yields where they wish (correct)

When the bond price goes up, the yield goes down. (correct)

This intervention weakens the domestic currency, ceteris paribus (false assumption), Interest rates do impact investment flow but higher rates and more investment inflows can be offset with trade outflows so this assumption may not necessarily become true.

The central bank stands ready to print money, which expands the money supply (false assumption),

So that it may purchase bonds in a quantity sufficient to reduce yields to below the cap. (correct)

The bull market will return because there’s more USD floating in the economy (there’s more to this)

Whilst this sounds amazing in theory, in a vacuum QE =/= money printing and an increase in monetary supply (which is what will cause a bull market). In order to understand the conditions that would lead to a bull market we must understand why QE did not work to devalue the Yen and create inflation in Japan after the housing bubble collapse of 1989.

Debunking some assumptions

There were 3 reasons why QE failed in Japan, the first two are a) the scale of their purchases were too small b) the asset purchases were predominantly short-term securities.

The most important reason is that BOJ purchased Japanese government bonds, these were predominantly acquired from commercial banks, not from nonbanks. This increased the monetary base but had a negligible impact on M2 or broad money growth.

If the Japanese Central Bank were to buy securities from non-banking entities this is what would’ve happened:

The central bank purchases government securities from nonbank entities.

Nonbank entities (e.g., insurance companies, pension funds, asset managers, or foreigners) sell government securities to the central bank.

The sellers receive new deposits from the central bank in settlement of their sale, which expands the money supply.

The sellers deposit their newly acquired funds in commercial bank deposit accounts.

Ultimately, it is the creation of new banking deposits which will lead to a growth in M2 and fundamentally, an increase in the quantity of money in the economy.

Comparisons of different types of QE

Side by side this is what happened in Japan in post-1989 and the US post-2008.

Japan (unsuccessful)

- The central bank buys securities from commercial banks. Bank holdings of JGBs and BOJ holdings increase.

- Commercial banks receive a credit from the BOJ for the sale of their JGBs and so reserve deposits of banks at the BOJ increase.

- Both sides of the balance sheet have increased but M2 has not

- Commercial banks have essentially swapped assets with central banks, and they have not had any new deposits = no increase in M2.

United States 2008 (successful)

- FED buys securities from nonbanks

- The sellers receive new deposits from the central bank = increases M2. Non-banking institutions deposit acquired funds in commercial banks.

- Balance sheet of the nonbank public has not increased—it has simply become more liquid (government securities are replaced with new deposits).

- M2 in the hands of firms and households has now increased and since IR rates are low it will encourage holders to shift the ratio between consumption and savings.

So how does Arthur Hayes’ thesis come true and wen bull market?

Inflation is at record highs, largely due in part to the war in Ukraine. This has substantially increased costs along the supply chain in particular for food and energy. Moreover, the threat of China invading Taiwan has also exposed how vulnerable the global economy is to a semiconductor shortage, Taiwan produces >60% of the global supply. My point is underinvestment in crucial infrastructure (energy, supply chains) has left the world exposed to socio/economic/political shocks.

What will create another bull market similar to 2020 is QE combined with fiscal spending. For instance, the US could issue new treasuries to pay for increased fiscal spending which can include new infrastructure (a $52 billion semiconductor bill was passed to increase production in the US this week) or subsidies for food and energy (which we may see come this winter).

Ultimately, we hope we’ve shown that QE does not necessarily equal money printing as this heavily depends on QE creating new banking deposits in the system much like in the way the 2020 stimulus checks and furlough schemes put newly printed money directly in the hands of US citizens. Don’t consume information in a vacuum, be open to seeking information which goes against your bias so that whichever comes, bull or bear, you are prepared and have a financial plan for both.